TIFIN’s AI Assistant has added several new capabilities for those who have linked their brokerage and other accounts, leading to strong growth in user adoption of this capability in its first year

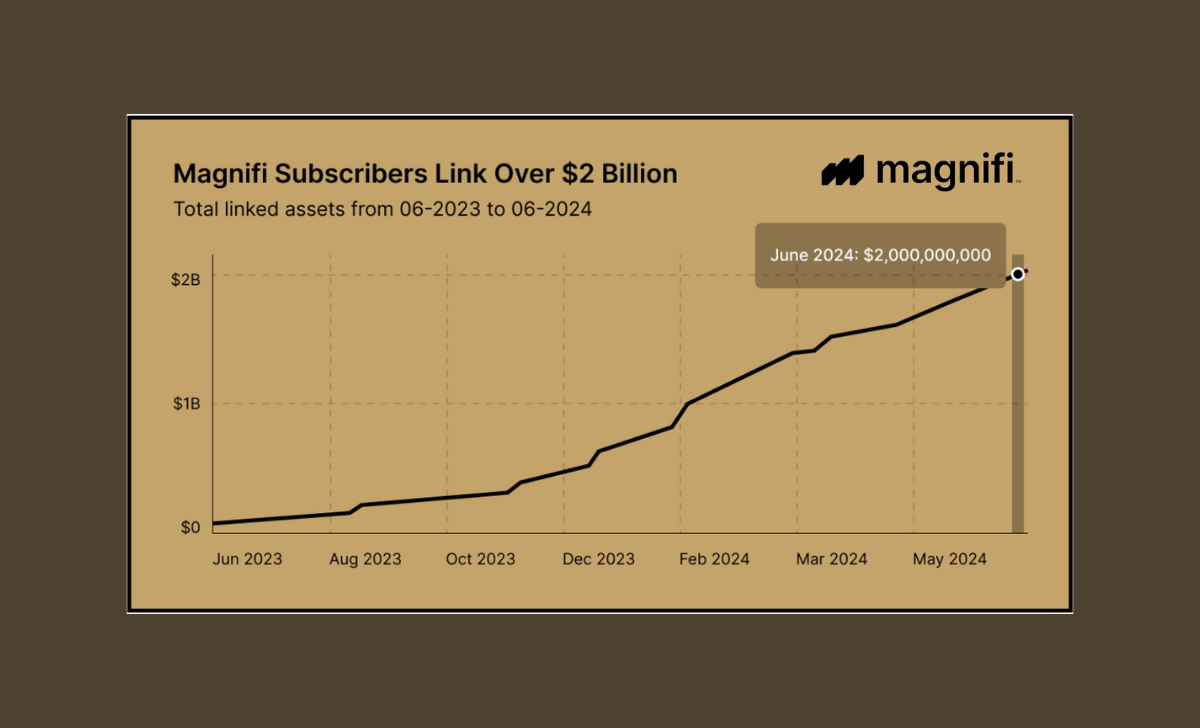

BOULDER, Colo. and NEW YORK, June 26th, 2024 — Magnifi by TIFIN, the AI-powered financial assistant for individual investors, has crossed a new milestone in providing individuals with real-time intelligence on their connected investment accounts. Magnifi users have now linked more than $2 billion in assets across their brokerage and self-directed accounts, showing impressive growth in the demand that individual investors have for AI-powered investment support. What started in 2023 with the ability to identify hidden risks across a customer’s investment accounts has grown to include end-to-end performance monitoring, personalized market alerts, portfolio health checks, and buy/sell impact analysis — all available in a generative AI interface.

Magnifi is leading the way in terms of an investment AI assistant that can look across all of an individual’s investment portfolios, to highlight where an investor has too much risk, analyze portfolio holdings, alert to market movements, and recommend potential improvements. The AI technology, built in-house at Magnifi, can leverage the information from the connected accounts to answer specific questions such as: “What happens if I buy NVDA?”, “How much Apple do I own?”, “What happens to my portfolio if interest rates rise?”, and more.

While users can trade directly on Magnifi, the firm does not generate revenues from commissions or order flows. Instead, users pay a monthly or annual subscription fee to use the service.

“In the last year we have seen incredible demand from individual investors to gain better insight and intelligence on their holistic investment positions across multiple accounts,” says Magnifi Chief Operating Officer, Tom Van Horn. “Magnifi provides the ability for users to link multiple investment, brokerage, and 401k accounts to understand their portfolio health, concentration risk, and how macro events impact their performance. We anticipate this demand to accelerate further as Magnifi serves more and more individuals.”

To experience how Magnifi’s AI assistant can answer an individual’s investing questions, visit magnifi.com.

About TIFIN

TIFIN is an AI and innovation platform for better wealth outcomes. Founded by Dr. Vinay Nair, TIFIN creates and operates new companies that apply data science, AI, and technology to address frictions in wealth and asset management. TIFIN’s companies have included 55ip (sold to JP Morgan), Paralel and currently include Magnifi, TIFIN Wealth, TIFIN Give, TIFIN AG, TIFIN AMP, Sage, Helix, and TIFIN @Work. TIFIN has been backed by JP Morgan, Morningstar, Hamilton Lane, Franklin Templeton, SEI, Motive Partners, and Broadridge among others.

Media Contacts

Michael Walsh

michael@therudingroup.com

AJ Boury

The information contained herein should in no way be construed or interpreted as a solicitation to sell or offer to sell advisory services. All content is for informational purposes only.